With all of the volatility in the stock market and uncertainty about the Coronavirus (COVID-19), some are concerned we may be headed for another housing crash like the one we experienced from 2006-2008. The feeling is understandable. Ali Wolf, Director of Economic Research at the real estate consulting firm Meyers Research, addressed this point in a recent interview:

There are many reasons, however, indicating this real estate market is nothing like 2008. Here are five visuals to show the dramatic differences. |

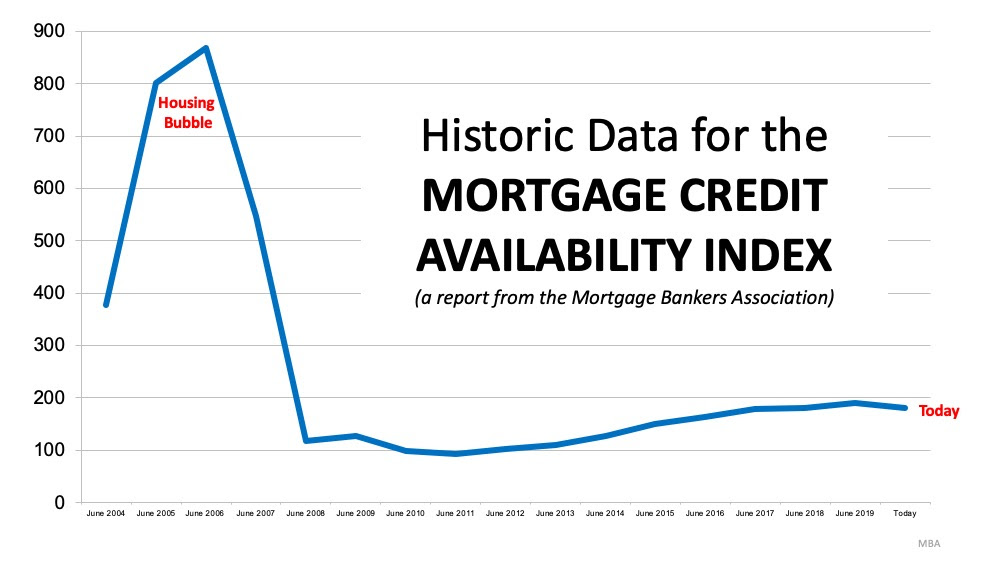

1. Mortgage standards are nothing like they were back then.

During the housing bubble, it was difficult NOT to get a mortgage. Today, it is tough to qualify. The Mortgage Bankers’ Association releases a Mortgage Credit Availability Index which is a summary measure which indicates the availability of mortgage credit at a point in time. The higher the index, the easier it is to get a mortgage. As shown below, during the housing bubble, the index skyrocketed. Currently, the index shows how getting a mortgage is even more difficult than it was before the bubble. |

2. Prices are not soaring out of control.

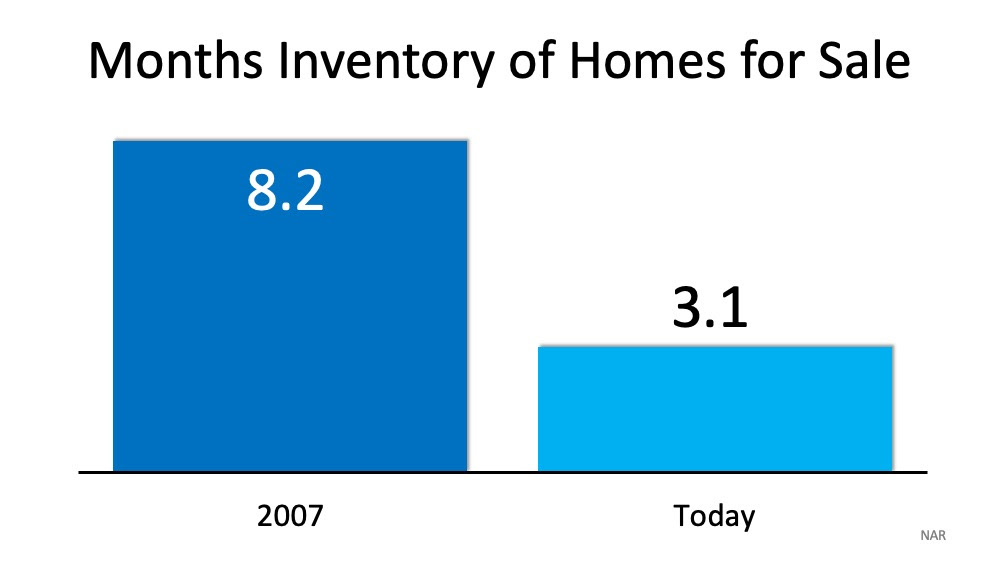

3. We don’t have a surplus of homes on the market. We have a shortage.

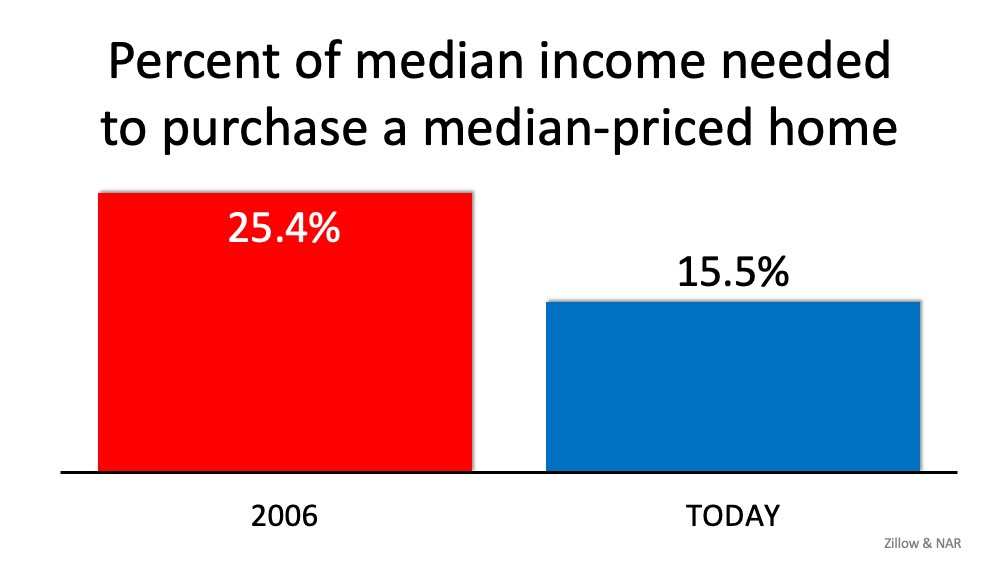

4. Houses became too expensive to buy.

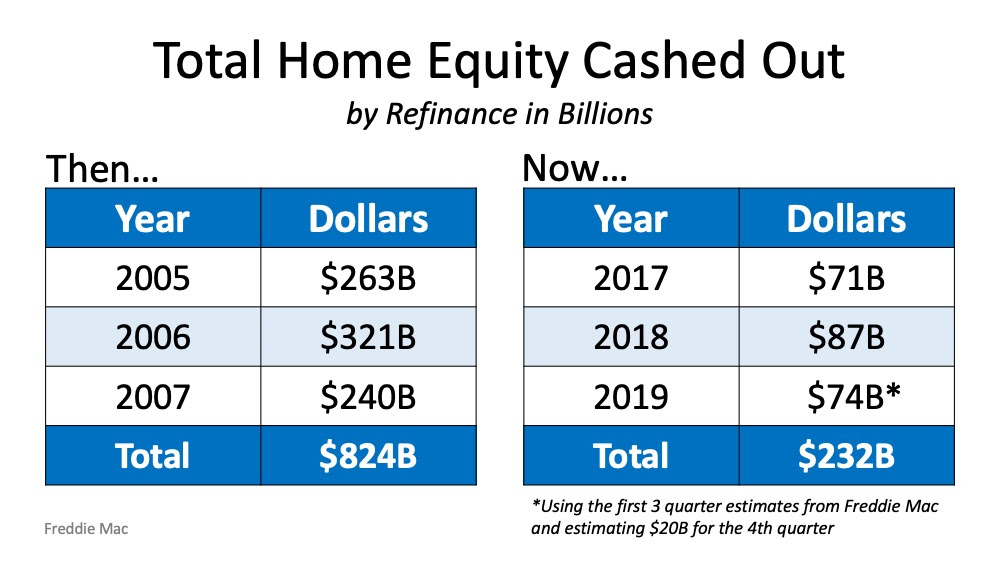

5. People are equity rich, not tapped out.

Bottom Line

| If you’re concerned we’re making the same mistakes that led to the housing crash, take a look at the charts and graphs above to help alleviate your fears. |